Why Consider Net Working Capital During Financial Due Diligence

Net Working Capital (“NWC”) is often overlooked in mergers and acquisitions (“M&A”) until late in the negotiations; however, we urge our clients to begin addressing this topic and the process of negotiating NWC earlier in the deal process for better overall efficiency.

NWC plays a crucial role in M&A transactions primarily due to the following three areas:

- Operational expense assessment: NWC provides a clearer picture of ongoing operating expenses. Buyers will use NWC to evaluate the acquisition and understand how efficiently the company manages its short-term assets and liabilities.

- Financial health indicator: The NWC number generally reflects the overall financial health of the company, particularly its liquidity. It helps buyers and sellers assess the company’s ability to meet its short-term obligations.

- Purchase price impact: Working capital directly impacts the purchase price. The average working capital peg (often referred to as “the Peg” or “the Target”) determines the cash required to operate the business post-transaction. Understanding NWC helps avoid unanticipated cash infusions.

Why is Net Working Capital important?

Net Working Capital is defined as the difference between a company’s current assets and current liabilities, which typically indicates whether a company is operating at a level where it can meet its current financial needs. The calculation of net working capital typically excludes cash, restricted cash, and current portions of indebtedness and debt-like items. This structure assumes that the seller will keep any cash that remains on the balance sheet at the time of a transaction, as well as retain the obligation to pay off any debts at the transaction close. We refer to this as the “our watch, your watch” mentality.

Having an accurate view of adjusted Net Working Capital (exclusive of intercompany eliminations, nonrecurring or one-time transactions or accruals during the period, and normalization of any inconsistencies throughout the period) can assist in highlighting any positive or negative trends in the business throughout the analyzed historical period. Additionally, this adjusted view of Net Working Capital can be an extremely useful tool as part of the overall analysis of the company and assist in telling its overall story, whether it be pre-revenue, development, or growth stage.

Therefore, in most deals, it is crucial to ensure that Net Working Capital is not only analyzed but included as a key piece of the overall diligence of a business.

Why Is Net Working Capital Often Overlooked?

Often, the focus and conversations between the transacting parties and advisors so heavily focus on the Quality of Earnings (which strictly focuses on the adjusted EBITDA of the business and does not take into account the balance sheet of the company), that Net Working Capital analyses are overlooked. However, as we discuss below, the analysis and subsequent calculation of Net Working Capital is vital to determining the financial health and value of a company.

Maxwell Heller, M&A Advisory Practice Leader at Centri, provided additional context to the importance of Net Working Capital: “Net Working Capital is a critical component of an M&A transaction. The true-up or true-down can often have a material impact on deal economics. We too often see this area left in the hands of inexperienced deal professionals. More attention needs to be paid to this earlier in the deal process.”

Impact of Net Working Capital on the Valuation of a Business

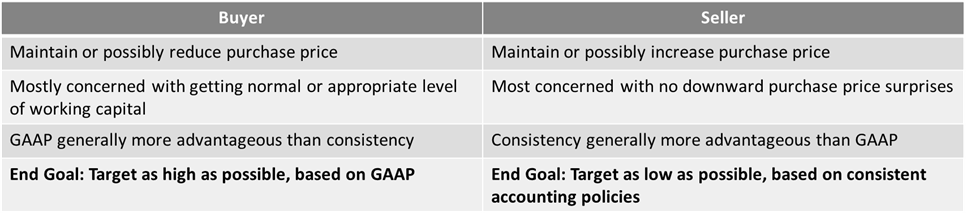

Net Working Capital is typically an input within the transaction equation. In addition to factors such as cash consideration, equity consideration, indebtedness, and other factors that play into calculating a purchase price, the concept of a Net Working Capital peg or target is typically included within the final purchase price calculation. The concept of a Net Working Capital target is a calculation of the required net working capital at the date of closing of the transaction. If the actual balance of Net Working Capital on the date of the transaction calculated exceeds the balance of the Net Working Capital target established, the purchase price will typically increase dollar for dollar by the balance that is exceeded, resulting in additional consideration for the seller. Conversely, if the actual Net Working Capital is below the target, the purchase price will decrease dollar for dollar and result in less consideration transferred from the buyer to the seller. Below is a table illustrating how Net Working Capital impacts the purchase price and the goal of calculating the Net Working Capital target in the context of a transaction, depending on which side of the deal those involved fall on:

How Centri Can Help

With a combined 50+ years of M&A Advisory experience and assistance in 500+ deals, Centri’s professionals have a wide range of knowledge and expertise that can assist in financial due diligence within any industry. As a firm that focuses on collaboration and quality, we work with clients to deliver solutions tailored to their needs while providing invaluable guidance and consultation throughout the entire deal process. Most importantly, we collaborate closely with clients to ensure that deliverables are aligned with expectations and that they are involved in the process every step of the way.

Additionally, Centri can provide further assistance in areas such as strategy, legacy planning, sell-side readiness, and many other areas for businesses currently looking for or planning for future transactions. Please contact us for more information or to explore how Centri can assist in the future of your business.

Director | CPA

John is a Director at Centri Business Consulting. He has more than 7 years of public accounting and consulting experience. View John Cooney's Full Bio

About Centri Business Consulting, LLC

Centri Business Consulting provides the highest quality advisory consulting services to its clients by being reliable and responsive to their needs. Centri provides companies with the expertise they need to meet their reporting demands. Centri specializes in financial reporting, internal controls, technical accounting research, valuation, mergers & acquisitions, and tax, CFO and HR advisory services for companies of various sizes and industries. From complex technical accounting transactions to monthly financial reporting, our professionals can offer any organization the specialized expertise and multilayered skillsets to ensure the project is completed timely and accurately.

Centri’s Capital Conference

The Centri Capital Conference is a one-day event held at Nasdaq on April 22, 2025. This platform will connect investors with executives from presenting companies in various emerging and rapid-growth sectors, including disruptive technology, life sciences, healthcare, and more. The conference will feature industry panels, dynamic speakers, and networking opportunities and will give growth-oriented private and public companies a place to showcase their innovations.

For more details, contact us at capitalconference@centristage.wpengine.com.

Eight Penn Center

1628 John F Kennedy Boulevard

Suite 500

Philadelphia, PA 19103

530 Seventh Avenue

Suite 2201

New York, NY 10018

4509 Creedmoor Rd

Suite 206

Raleigh, NC 27612

615 Channelside Drive

Suite 207

Tampa, FL 33602

1175 Peachtree St. NE

Suite 1000

Atlanta, GA 30361

50 Milk St.

18th Floor

Boston, MA 02109

1775 Tysons Blvd

Suite 4131

McLean, VA 22102

One Tabor Center

1200 17th St.

Floor 26

Denver, CO 80202

1-855-CENTRI1

virtual@CentriConsulting.com