Segment Disclosure Updates – Significant Expense Principle

In November 2023, the Financial Accounting Standards Board (FASB) issued an Accounting Standards Update (ASU 2023-07) with the goal of enhancing segment disclosures under Topic 280 – Segment Reporting. This Update is applicable for all public entities.

The amendments in this Update improve reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expenses. Current GAAP requirements only require certain segment expenses such as depreciation and amortization to be disclosed by segment. The amendments in this Update require that a public entity disclose, on an annual and interim basis, significant segment expenses that are regularly provided to the Chief Operating Decision Maker (CODM) and included within each reported measure of segment profit or loss (collectively referred to as the “significant expense principle”).

The significant expense principle requires companies to disclose information about significant segment expenses that are also being evaluated in assessing segment performance and determining how to allocate resources. As noted in ASU 280-10-50-26A, the significant expenses need to be:

- Regularly provided to the CODM

- Easily computable

- Significant, considering both qualitative and quantitative factors

- Included in segment profit or loss reportable measure(s)

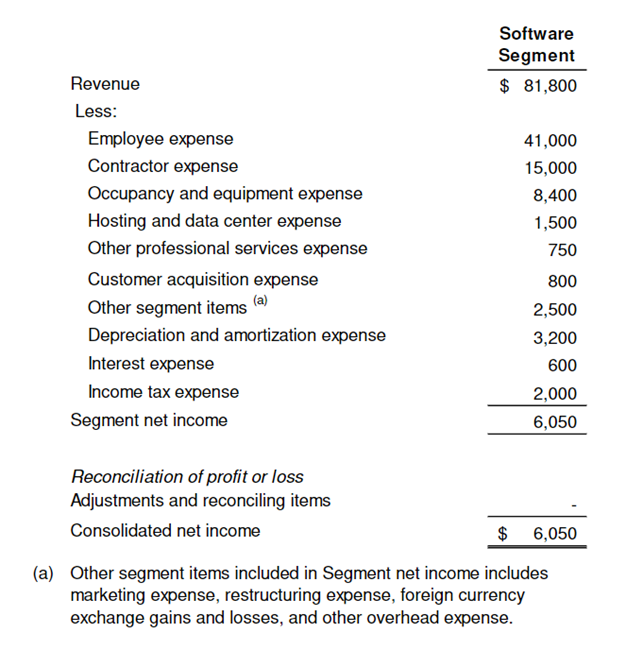

The new ASU clarifies that public companies with a single reportable segment are required to provide all the disclosures required by the standard. ASU 280-10-55-55 provides an illustration for presenting significant segment expenses for a company with one reportable segment:

Companies are required to disclose significant expenses for each reportable segment on an annual and interim basis. Companies are required to reconcile segment disclosures; therefore, an amount for other segment items is required, representing the difference between total reported segment revenues, less significant segment expenses, and the reported segment profit or loss. The other segment items are required to have a description of the composition, which includes the nature and type of such items. Companies may identify different significant expenses for each reportable segment. Further, significant expense categories will differ from what other public companies disclose.

The amendments in this Update are effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024. Early adoption is permitted. A public entity should apply the amendments in this Update retrospectively to all prior periods presented in the financial statements. Upon transition, the segment expense categories and amounts disclosed in the prior periods should be based on the significant segment expense categories identified and disclosed in the period of adoption.

How Centri Can Help

- Serving as the central point of contact for the working group, ensuring that responsibilities are clearly defined and critical deadlines are met.

- Reviewing your current system and its capabilities to identify the significant segment expenses to be reported within the appropriate timeframe.

- Developing/enhancing internal controls over the identification and reporting of the significant segment expenses to be reported in the footnote, as well as developing control activities over how the CODM is using these reported expenses to measure segments’ profit/loss.

- Enhancing existing segment documentation in a memorandum to align with the new ASU, or if one has not been previously prepared, preparing a memorandum of how the Company complies with ASC 280, including the adoption of this Update.

- Assisting with the preparation of the segment footnote and its related required disclosures in the financial statements.

At Centri, our team of technical accounting experts has the knowledge and expertise to help your business navigate the new requirements. Contact us to learn more.

Partner | Technical Accounting Practice Leader | CPA

Blake is a Partner at Centri Business Consulting and the leader of the firm’s Technical Accounting Practice. He has more than 18 years of public accounting experience. View Blake Roberts's Full Bio

Managing Director | CPA, MBA

Mike is a Managing Director at Centri Business Consulting. He has more than 16 years of accounting, advisory, and audit experience. View Michael Kirchner's Full Bio

About Centri Business Consulting, LLC

Centri Business Consulting provides the highest quality advisory consulting services to its clients by being reliable and responsive to their needs. Centri provides companies with the expertise they need to meet their reporting demands. Centri specializes in financial reporting, internal controls, technical accounting research, valuation, mergers & acquisitions, and tax, CFO and HR advisory services for companies of various sizes and industries. From complex technical accounting transactions to monthly financial reporting, our professionals can offer any organization the specialized expertise and multilayered skillsets to ensure the project is completed timely and accurately.

Centri’s Capital Conference

The Centri Capital Conference is a one-day event held at Nasdaq on April 22, 2025. This platform will connect investors with executives from presenting companies in various emerging and rapid-growth sectors, including disruptive technology, life sciences, healthcare, and more. The conference will feature industry panels, dynamic speakers, and networking opportunities and will give growth-oriented private and public companies a place to showcase their innovations.

For more details, contact us at capitalconference@centristage.wpengine.com.

Eight Penn Center

1628 John F Kennedy Boulevard

Suite 500

Philadelphia, PA 19103

530 Seventh Avenue

Suite 2201

New York, NY 10018

4509 Creedmoor Rd

Suite 206

Raleigh, NC 27612

615 Channelside Drive

Suite 207

Tampa, FL 33602

1175 Peachtree St. NE

Suite 1000

Atlanta, GA 30361

50 Milk St.

18th Floor

Boston, MA 02109

1775 Tysons Blvd

Suite 4131

McLean, VA 22102

One Tabor Center

1200 17th St.

Floor 26

Denver, CO 80202

1-855-CENTRI1

virtual@CentriConsulting.com